Nashville has many government-backed mortgage programs available today. There are three such programs available and they each serve a different audience. They are the FHA, VA and 100% USDA programs.

Conventional loans are those that are issued and guaranteed by the individual lender approving the loan. There is no guarantee of any sort from any government program. Most of these loans fall under guidelines by Fannie Mae and Freddie Mac. Basically, if a loan should ever default, the lender takes the loss.

With a government-backed loan, should the loan go into default the lender is compensated for all or part of the loss due to foreclosure. Which mortgage program is the best one for your situation will depend on many variables discussed below. Please feel free to reach out to us anytime by calling the number above, or just submit the Quick Request form on this page.

FHA Loan Program

FHA Loan Program

The FHA loan is the oldest of the three, having been introduced back in 1934 as a way to help jump-start a struggling economy, and today is the most popular choice. How does home buying help an economy? Because there are other industries that benefit when real estate is bought and sold. It’s not just a singular transaction.

When someone sells a home, they typically buy another, so in many cases a home sale actually triggers a series of sales down the line. A seller sells the home and buys another from another seller who will buy another and so on. There are of course exceptions when the heirs of an estate sell a property, but in general, there are several “legs” in a purchase transaction.

Okay, back to the economic impact of real estate. When a couple buys a home it’s likely they’ll soon be heading to the appliance store to upgrade a kitchen or to get referred to a contractor to remodel the master bath. Maybe the carpet will be pulled up and wood floors put down. Even something as minor as a fresh coat of interior paint will have an impact as buyers head to home improvement stores and buy stuff.

Prior to the introduction of the FHA program, banks were a bit reluctant to issue mortgage loans. Mortgages were provided to buyers by loaning the amount from their own vaults. If the loan went into default they would be out the money lent to buy the home as well as having a piece of real estate on their hands they really didn’t want. To compensate for this risk, banks asked for down payments of 30, 40 and even 50 percent down. Required down payments this high unfortunately kept many on the sidelines. Enter the FHA loan.

The FHA set forth specific guidelines that if the lender followed them when approving a loan, should the loan go into default the lender would be compensated. The FHA loan is really less of a mortgage program than an insurance policy. This new mortgage program then allowed banks to offset much of the risk and with lower down payments, allowing more people to qualify for a home loan.

The cost for this insurance premium is for two separate policies, an upfront premium rolled into the mortgage loan and an annual premium paid in monthly installments. All government-backed mortgage programs have some sort of mortgage insurance policy.

Today, the minimum down payment for an FHA mortgage is just 3.5% of the sales price of the home. In addition to the low down payment, FHA loans are easier to qualify based on credit and income guidelines. These features alone make the FHA program the ideal choice for buyers who want a competitive loan program with as little cash to close as possible. While FHA loans aren’t reserved exclusively for first-time buyers, it’s by far the most popular loan choice for someone who has never owned a home.

FHA loans remain the most popular option for today for homebuyers in Nashville -Davidson County.

VA Loan Program

VA Loan Program

For those that qualify and who want to come to the settlement table with as little cash as possible, the VA program is hard to beat. Why? First, there is no down payment needed at all.

Second, the borrowers are restricted from paying certain closing costs, keeping cash to close lower. Finally, there is NO monthly mortgage insurance payment or PMI, increasing buying power and lowering monthly payments.

Who is eligible for this program? Active-duty military personnel with at least 181 days of service, veterans of the armed forces, members of the National Guard or Armed Forces Reserves with at least six years of service are eligible as are un-remarried surviving spouses of those who have died while serving or as a result of a service-related injury.

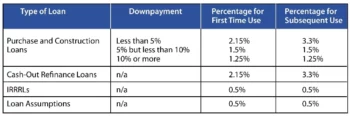

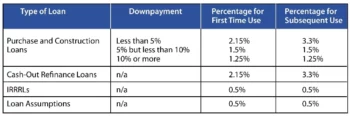

With the VA program, the one-time premium is referred to as the funding fee. This fee varies based upon its use and loan term, but for first-time buyers using the VA program and taking out a 30-year fixed rate loan, the fee is 2.15% of the loan amount and rolled into the loan. Using a $200,000 sales price and zero down, the fee is 2.15% of $200,000 or $4,300. The $4,300 is rolled into the loan and the final loan amount is $204,300. * Please find the latest VA funding fee chart below.

On the loan application, there is a section where the applicant checks the box that says, “VA” but the lender, as well as lending guidelines, require the lender to obtain further verification. This verification is provided with a copy of the Certificate of Eligibility which is provided by the Department of Veteran’s Affairs. Borrowers can obtain this certificate by visiting one of the regional VA offices in person, by mail or by fax or online, but the most convenient way is to have us order it for you

Most lenders have access to the VA’s ACE system or Automated Certificate of Eligibility. When they make a request for your certificate, it comes within a matter of moments.

100% USDA Rural Housing

100% USDA Rural Housing

The third government-backed program is from the United States Department of Agriculture or “USDA” This might sound odd that the USDA is even involved in mortgages, but its goal is to help expand rural communities by financing homes with zero down payment. USDA and VA are the only 100% financing government programs today.

The Census Bureau surveys the U.S. population once every 10 years and from this data, the USDA identifies areas that are approved for the program. The home must be in an eligible area before the loan can be approved. The second requirement limits household income to 115% of the median income for the area.

Please find all the USDA income eligibility here. Use the “Section 502 Guaranteed Rural Housing Loan Program” income limits. Note, most of Tennessee will have a household income limit of $110,650+ for a family of 1–4 members. Even higher for larger families with 5+ members, and in certain counties like Davidson.

Like the other programs listed above, USDA loans come with a secure 30-year fix rate and no early pay-off penalties.

What Loan is Right for You?

If you have VA eligibility and want the lowest cash to close as possible with low monthly payments, the VA loan is your best choice. If you’re not VA eligible but still want a zero down loan and the property is located in an area deemed rural and your household income does not exceed 115% of the median income for the area, the USDA is your choice.

Finally, if you’re not VA or USDA-eligible but still want a low-cost loan, the FHA is a great choice. There are no restrictions with an FHA loan as it relates to income or location. And while the FHA does have a down payment requirement, 3.5% is within reach for most buyers.

Please contact us today to learn more about any of the programs listed above.