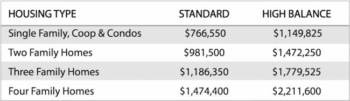

As the name suggests, Jumbo Home loans are great for high-priced or luxury home purchases. A Jumbo mortgage is an alternative when the amount of the loan exceeds the standard conforming loan limits listed below. The 2024 Conforming Loan Limit is $766,550 except for some high-cost locations in CA, CO, South Fla, Northeast, Virginia/DC.

The underwriting process is similar to that of other loan processes, except in some cases 2 appraisals may be required. A larger down payment is also required with a jumbo loan, generally at least 10%. If you have a lower debt-to-income ratio, (43% or less) and a higher credit score, 700 or higher, then a Jumbo loan may be right for you.

Benefits of a Jumbo Home Mortgage?

✔ Large loan amount

✔ Quick turn-around

✔ Convenient financing of a large dollar amount property

✔ Fixed and adjustable finance rates available

✔ Competitive pricing

Dream big and own big! Coast 2 Coast Lending will work with you to make your dream come true by simplifying the application process. Jumbo loans are becoming more popular and interest rates are near their lowest ever. Along with its popularity, Jumbo loans are becoming easier to apply for than in recent years. We are experienced with these loans and will make your mortgage experience a pleasant one!

We have loan specialists standing by 7 days a week to help you, please submit the Quick Contact form to expedite your request quickly or call the number above.