There are two basic types of loans, those that are considered conforming and those that are non-conforming. These descriptions apply to loans that “conform” to standards issued by Fannie Mae and Freddie Mac. When lenders issue a loan using conforming guidelines, the loan is then eligible for sale in the secondary market. Selling loans allows […]

General Mortgage

Nashville Government Mortgage Offerings 2024

Nashville has many government-backed mortgage programs available today. There are three such programs available and they each serve a different audience. They are the FHA, VA and 100% USDA programs. Conventional loans are those that are issued and guaranteed by the individual lender approving the loan. There is no guarantee of any sort from any […]

Conforming Limit Changes 2024

Consumers may have heard the term “secondary market” as it relates to housing but it’s not very likely. Lenders, however, are very familiar with the term as the secondary market is the lifeblood of the industry. Without it, home loan lending would slow to a crawl resulting in fewer people being able to afford a […]

Purchasing a House Within Your Income Range

Tired of renting? Did someone at work just buy a home and they can’t wait to close? Did you recently get bitten by the “home buying bug?” It happens at some point to all of us. Even if you’re not ready to buy your own home at least you’ve thought about it. But if you’re […]

Different Types of Adjustable Rate Mortgage Programs

There are many varieties of mortgage programs today, but all of them fall into one of two categories – fixed or adjustable. A fixed rate loan is pretty easy to figure out, it’s fixed for the life of the loan and will never change. A fixed rate loan is the more popular of the two, […]

First Time Home Buyers and IRA Accounts

There are several first-time buyer programs. Many are state or locally sponsored in the form of grants or no-interest loans. A grant is essentially free money. For someone who qualifies for a grant, the funds are issued and as long as the borrowers keep the property for a specific period of time, say for at […]

Divorce, Separation and Real Estate

No one gets married with thoughts of ending the marriage at some stage later on. It’s a lifelong commitment to live happily ever after, for better or worse. But sometimes things get so bad it’s beyond “worse” and the couple decides to make some changes. When a married couple buys real estate together but later […]

Installment Debt, Revolving Debt and Qualifying for a Mortgage

One of the primary tasks a lender must perform is to determine affordability. A mortgage company must make a reasonable determination that the applicants will be able to afford the new mortgage payment along with associated property taxes and insurance. The mortgage includes both an amount to principal and interest. These four payments are referred […]

Using Zillow or Similar Site to Value Your Home? You May Be Selling Yourself Short

Zillow was introduced years ago and since then has become a major force in the real estate industry. Zillow isn’t a real estate company although the site shows millions of homes for sale and rent in all parts of the country. Instead, Zillow is a database and draws listings from multiple sources and works with […]

Mortgage Protection Insurance: Is It Worth It?

Have you heard this term? Maybe you got a letter in the mail from a company offering insurance to cover your mortgage? But why would you need mortgage insurance to cover your mortgage? There are a couple of reasons, one is to temporarily make your mortgage payments should you be unable to work and the […]

Why Are Discount Points Eligible for an Income Tax Deduction?

There are still several income tax deductions available to the everyday taxpayer. Several years ago, all sorts of interest, including credit card interest, was available as an income tax deduction. During the overhaul of the income tax code way back in 1986, several popular deductions were eliminated. We’ll talk about some of them but it’s […]

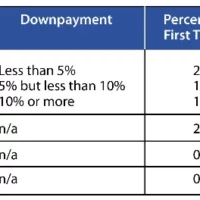

Private Mortgage Insurance Isn’t Forever: When You Can Remove PMI

Private mortgage insurance, or PMI, sometimes gets a bad rap. And that’s unfortunate because PMI plays a very important part in the mortgage industry. Years ago, banks would require down payments of as much as 30 or 40 percent of the sales price. Back then, banks assumed all the risk on the loan and if […]

Sorting Through All Your Loan Options

If you’ve never had a mortgage before, you’ll likely be surprised at how many choices you have. Sometimes it can be a bit overwhelming when your loan officer begins presenting your different choices. Lenders can boast about how many different loan programs they have but sometimes it clouds the decision-making process with too much information. […]

What To Expect At Your Home Closing

All the prep work has been done and your lender has told you your closing papers are being prepared and delivered to your escrow officer or settlement agent. A lot was said and done since the time you first spoke with a loan officer and began asking a series of questions on qualifying, applying for […]

How Much Can Home Sellers Contribute Toward Your Closing Costs

Saving up enough money for a down payment is typically the single biggest obstacle first time home buyers face. For those who already own a home and are contemplating selling and buying another, the accrued equity in the home is usually enough to take care of a down payment for the subsequent home. First-time buyers […]

6 Home Upgrades to Avoid

Whether you just bought a fixer-upper that needs more than just a little “TLC” or you’ve lived in your home for a few years and ready for a remodel, there are some things you should do and especially things you shouldn’t do. Of course, if you did buy a home that needs a little help, […]

5 Hidden Costs of Homeownership

When consumers carefully consider buying a home, most of their attention is directed at how much money is needed for a down payment, how much are my closing costs and how much money do I need overall to close the transaction. Those are important considerations and your loan officer can provide you with a pretty […]

Rising Interest Rates, What Can Buyers Expect?

We’ve enjoyed some very competitive interest rates over the past few years. This has helped the housing market not only recover but thrive in multiple markets across the country. Today, it’s common to find a 30 year fixed rate for a conforming loan amount in the 4.00% to 4.25% with some variance. These rates hit […]

Should First Time Buyers Use Adjustable Rate Mortgage?

Should first time buyers use an adjustable rate loan or a hybrid as their very first mortgage? “First timers” when starting out on their home buying journey can be somewhat surprised at all the decisions they must make. The biggest choice is whether or not they want to buy in the first place. Making the […]

First Time Buyers? What To Expect

If you’re on the brink of buying your very first home, most any homeowner today will tell you it’s the fastest 30 days you’ve ever experienced. Why? one of the main reasons is there are a lot of “firsts” going on and third parties you’ve never heard of all working on your loan file. But […]