Veteran Affairs or “VA” loans have always been a popular choice for eligible vets searching for an affordable mortgage. After all, there aren’t many mortgage options left in the U.S. today for 100% financing. VA loans are unique in the way that they do not require down payments.

The program is available to all eligible veterans and active members of the military and is provided by approved lenders with the “backing” of the Department of Veteran Affairs. One of the top benefits of VA loans is they still do not require monthly mortgage insurance – PMI.

For buyers in Norfolk with no means for down payments, the VA loan remains one of the very few options available. Millions of active military personnel and veterans across the U.S. can qualify for this loan comparatively than more traditional conventional loans.

If you are looking to apply for a VA mortgage, below are some pointers you must know beforehand.

VA Loan Eligibility Criteria:

Military veterans, soldiers on active duty, National Guard members and reservists are all eligible for VA loans. Additionally, the spouses of the mentioned personnel who died while on duty or via a disability-related service are also eligible. Those on active duty usually qualify after a minimum service of 6 months. National Guard members and reservists are required to wait a total of 6 years to gain eligibility. However, should they be called to active duty, they become eligible after a service period of 181 days. This period is halved during times of war.

The advantages of VA loans:

Perhaps the biggest advantage of a VA loan is that there is no need for a down payment – 100% financing. Keeping in mind the often less than ideal financial situations of military personnel, this is a very big plus. Another advantage is that VA loans don’t require mortgage insurance. This results in significant savings on a monthly basis.

VA Funding Fees:

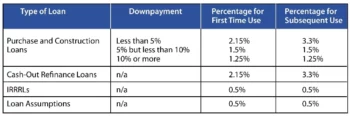

Similar to other government loan programs like FHA or USDA, a funding fee is added to the buyer’s base loan amount. The VA costs though are usually lower than most loan programs that feature a low down payment. These funding fees can vary depending on the down payment amount and how many times the borrower has used their VA loan benefits. Disabled Vets are often exempt from paying the VA funding fee. See the chart below:

VA Loan Underwriting Requirements:

The usual credit score preferred by VA-approved banks and lenders is 600 or above. However, slightly lower credit scores can often be approved for home buyers that have 5% or 10% down payment. No serious financial hardships within the previous 4 years is also important. Applicants should also prove sufficient, stable income at the time of application. They must not be too indebted, although even these guidelines are significantly more feasible and lenient than those for conventional loans.

VA Mortgage Limits:

The limits on VA loan limits can vary from state to state, most of Virginia will have a loan limit amount set at $766,550 with many high costs areas like around DC like Arlington, Fairfax, and Alexandria allowing up to $1,149,825 for a (1) unit primary home.

VA Refinance Options:

Va offers many great refinance options that include streamlined rate reduction refinance and cash-out refinance. Cash-out refinance up to 100% loan to value is possible in many cases. This is great for Vets that want to consolidate high-interest debt, or use the money for home improvements, etc.

Read more about VA loans here. Please call Ph: (904) 342-5507, or just submit the Quick Request Form on this page to speak with a loan specialist 7 days a week.

Serving Vets across Virginia including: Virginia Beach, Norfolk, Chesapeake, Arlington, Richmond, Newport News, Alexandria, Hampton, Roanoke, Portsmouth, Suffolk, Lynchburg, Centreville, Dale City, Reston, Harrisonburg VA