There are two basic types of loans, those that are considered conforming and those that are non-conforming. These descriptions apply to loans that “conform” to standards issued by Fannie Mae and Freddie Mac. When lenders issue a loan using conforming guidelines, the loan is then eligible for sale in the secondary market. Selling loans allows […]

Blog

Nashville Government Mortgage Offerings 2024

Nashville has many government-backed mortgage programs available today. There are three such programs available and they each serve a different audience. They are the FHA, VA and 100% USDA programs. Conventional loans are those that are issued and guaranteed by the individual lender approving the loan. There is no guarantee of any sort from any […]

VA Mortgage Highlights St. Johns County

Getting a VA home loan in St. Johns County might at first glance seem to be full of paperwork, hard to get and the loan process itself simply takes too long. First-time homebuyers can glean as much information as they can about the process but with all the different loan terms and qualification guidelines, it […]

Virginia First Time Buyer USDA Mortgage Guide 2024

First time buyers in Virginia are often surprised to find that the USDA still offers 100% home mortgages. In fact, the USDA RD mortgage is the last 100% home loan available in Virginia, unless the applicant has VA loan eligibility. The USDA mortgage program is designed to help promote homeownership in less populated locations around […]

Tampa First Time Buyer Programs: Pros and Cons

Purchasing a home can be a little nerve-racking, especially for Tampa first time home buyers. Beyond all mortgage preparation, there are many different people involved in the process. This includes the lender, realtor, closing agent, appraiser, and the list goes on. Applying for a home loan and getting preapproved by a mortgage lender should be […]

USDA Rural Housing Mortgage Income Limits Increase 2024

USDA Rural Development recently increased the household income limits for the 502 Guaranteed Program. This is great news, as this change will permit more families to qualify for the 100% Government-backed mortgage program. The current USDA income limits are listed below, these limits apply to most locations in the U.S. However, more expensive high-cost locations […]

Georgia USDA Loan Eligibility Checklist

Many locations in Georgia are still eligible for 100% USDA rural housing. Homebuyers considering a USDA home loan should first check they meet the USDA loan eligibility requirements. Below is a basic checklist of items that will determine if you are eligible for USDA financing. Keep in mind the program has certain eligibility and qualifying […]

USDA Loans Still 100% Financing

USDA Rural home loans are one of two last remaining 100 percent home loans still available in Florida. The other option is a VA loan which requires current or past military duty. As with any mortgage, there are groups of specific requirements that must be met before an applicant is approved. USDA Loan eligibility requirements […]

Conventional Loan Options Florida

By far the mortgage programs with the greatest market share in Florida are conventional loans. Conventional loans are typically underwritten by guidelines established by both Fannie Mae and Freddie Mac, but technically they are loans that do not come with a government-backed guarantee to the lender, including VA, FHA and USDA home loans. With a […]

VA Mortgage Guide For Norfolk Veterans

Veteran Affairs or “VA” loans have always been a popular choice for eligible vets searching for an affordable mortgage. After all, there aren’t many mortgage options left in the U.S. today for 100% financing. VA loans are unique in the way that they do not require down payments. The program is available to all eligible […]

Conforming Loan Limits Increase For 2024

Great news for home buyers, the 2024 conforming loan limits have increased to $766,550, please see the chart below. Please note, typical high balance locations are also increasing to $1,149,825 for standard 1-unit properties. Coast 2 Coast is proud to offer conventional loans up to the new loan limit effective today. Please connect with us […]

FHA Upfront – Loan Limits Texas

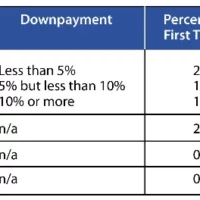

FHA loans have been around for a long time, as far back as 1934 when the program was first introduced. FHA loans have an inherent guarantee to the lender that compensates the lender at 100% of the foreclosed loan amount. FHA loans also have a very low down payment requirement of just 3.5% of the […]

Conforming Limit Changes 2024

Consumers may have heard the term “secondary market” as it relates to housing but it’s not very likely. Lenders, however, are very familiar with the term as the secondary market is the lifeblood of the industry. Without it, home loan lending would slow to a crawl resulting in fewer people being able to afford a […]

USDA, FHA and VA Loan Guarantees Explained

There are three government-guaranteed mortgages available today. They are the USDA, FHA and VA loan programs and each is designed for a specific type of borrower or situation. They’re called guaranteed because the lender that made the loans is compensated for part or all of the loss should the loan ever go into foreclosure. A […]

USDA Loan Requirements Georgia

USDA Rural Housing provides a great opportunity for Georgia homebuyers to purchase a home with very little money out of pocket. Please read below to learn about the basic USDA loan requirements for Georgia, please contact us today with questions. Credit score – 620 min credit score is required in most cases for 100% financing. […]

New 2024 FHA Loan Limits

FHA recently announced some great news for homebuyers using the loan program in 2024. The loan limits have increased nationwide and start at $498,257 and up for a single 1-unit property. Home buyers can view the new 2024 FHA loan limits here. The FHA mortgage program offers many advantages for homebuyers seeking to purchase a […]

2024 VA Loan Guidelines Georgia

If you’re one of those fortunate few that are eligible for the VA home loan program, congratulations. As a result of your service, you have hands-down access to the best financing option here in Georgia. VA loans are great for those seeking a mortgage program that requires as little cash to close as possible while […]

First Time Buyers Should Look for These Loan Programs in 2024

Let’s face it, applying for and documenting a mortgage application can sometimes be a bit intimidating. There are so many service providers and paperwork involved, and many times the paperwork can be a bit overwhelming. This is especially so for those who are buying their very first home. First-time buyers soon find out that applying […]

100% USDA Loan South Carolina

There are three government-backed mortgage programs available to South Carolina home buyers today. Those three are the USDA, FHA and VA loan programs. USDA and VA are the only two that still permit 100% financing. The VA loan does not require a down payment yet is only available for veterans of the Armed Forces and Reserves […]

First Time Buyer Florida FHA Loans

Florida buyers are surprised to learn the FHA loan was introduced back in 1934 and is still the top mortgage program for those purchasing their first home. And while FHA is not reserved only for first-time home buyers there are some reasons why it’s a good deal for those wanting to come to the closing […]